Home > Apps > Photography > Afterpay - Buy Now, Pay Later

Afterpay: Your Guide to Buy Now, Pay Later

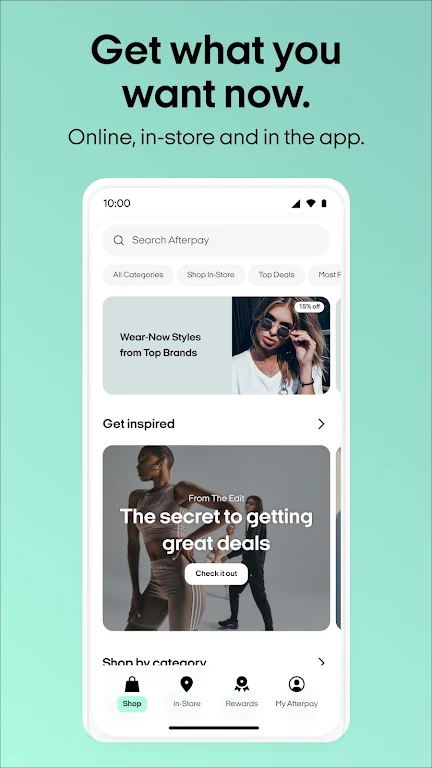

Afterpay is a financial technology app enabling users to purchase items and pay in installments. It provides a flexible payment solution for online and in-store shopping, allowing users to buy now and pay later without interest or fees (subject to terms and conditions). Afterpay partners with numerous retailers, offering diverse product access. Its intuitive interface and streamlined checkout process redefine the shopping and payment experience.

Key Afterpay Features:

- Exclusive App Benefits: Access exclusive deals and discounts available only through the Afterpay app, featuring a wide selection of brands and products.

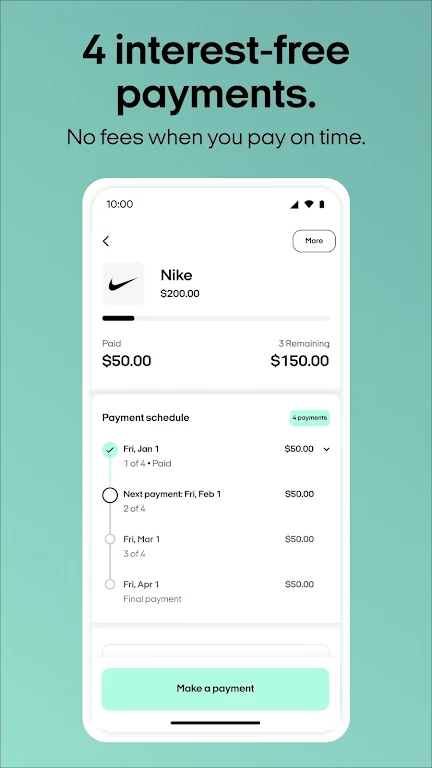

- Interest-Free Installments: Split purchases into four interest-free payments for budget-friendly shopping.

- Extended Payment Options: For larger purchases, choose to pay in 6 or 12 months at participating retailers.

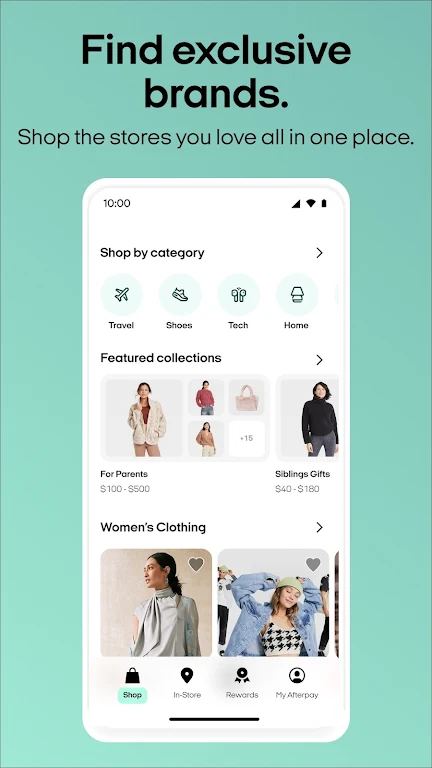

- App-Exclusive Brands: Discover unique brands and products only available via the Afterpay app.

Frequently Asked Questions (FAQs):

- In-Store Use: Yes, Afterpay is accepted at many in-store retailers.

- Payment Management: Easily manage payment schedules, pause payments for returns, and track order history within the app.

- Sale Alerts: Enable push notifications for sales and price drops on favorite items.

Detailed Feature Breakdown:

App-Exclusive Shopping: The Afterpay app offers a unique shopping experience with exclusive brand deals and the ability to split purchases into four interest-free payments, both online and in-store. Browse various categories including fashion, beauty, home goods, and more.

Flexible Payment Plans: Enjoy extended payment options of 6 or 12 months for larger purchases at participating retailers, providing greater financial flexibility.

Exclusive Brands and Curated Content: Discover exclusive brands and categories, along with daily curated shopping guides and inspirational content to stay on-trend.

Simplified Order Management: Easily review order history, adjust payment schedules, and pause payments for returns. Link to your Cash App for convenient order management.

Sale & Price Drop Notifications: Stay informed about sales and price drops on saved items through push notifications.

Seamless In-Store Shopping: Use your virtual wallet to pay in-store with Afterpay. The app pre-approves spending limits to aid budgeting.

Increased Spending Limits: Consistent on-time payments increase your spending limit.

24/7 Customer Support: Access 24/7 customer support chat within the app, along with FAQs.

Important Terms and Conditions:

-

Eligibility requires being 18+, a U.S. resident, and meeting additional criteria. In-store use may require further verification. Late fees may apply. See the installment agreement for complete terms. California residents: Loans are made or arranged pursuant to a California Finance Lenders Law license.

-

For the Pay Monthly program, loans are provided by First Electronic Bank, Member FDIC. A down payment may be needed, APRs range from 6.99% to 35.99%, depending on eligibility and merchant. Loans are subject to credit checks and approval and aren't available in all states. A valid debit card, accessible credit report, and acceptance of terms are required. Estimated payment amounts exclude taxes and shipping. Full terms are available on the Afterpay website.

Additional Game Information

Latest Version1.104.0 |

Category |

Requires AndroidAndroid 5.1 or later |

Afterpay - Buy Now, Pay Later Screenshots

Top Download

More >Trending apps

-

- Okuvaryum - Books for Kids

- 4.4 News & Magazines

- Okuvaryum: Digital Reading Platform for Kids!Okuvaryum is the ultimate digital reading platform for kids ages 4 and up. It offers a vast library of educational and entertaining children's books in Turkish, complete with beautiful illustrations and audio narration by voice actors. With new books added every month, Okuvaryum provides a fresh and engaging reading experience that helps children improve their listening, reading comprehension, and social skills.The app features a series format that helps young learners establish

-

- Loop Maker Pro: Dj Beat Maker

- 4 Tools

- Unleash your inner DJ with Loop Maker Pro! Create pro-quality beats and music with DJ loops and pads. Explore rock, EDM, and trap genres. Mix loops and pads for endless possibilities. Record your hits and share them with the world. Learn beat making skills with Loop Maker Academy. Experience the thrill of being a DJ with Loop Maker Pro!

-

-

- Insmate Downloader:Story saver

- 4.5 Tools

- InsMate: Download and Share Instagram Content with EaseInsMate makes downloading and reposting Instagram content a breeze. Effortlessly save videos, photos, stories, and reels to your gallery without logging in. Share IG content with one click, including captions and hashtags. Enjoy offline viewing of stories and high-quality downloads. InsMate's user-friendly interface and reliable service make it the ultimate Instagram companion.

-

-

- Rog Ka Upay

- 4.1 Communication

- Rog Ka Upay app offers comprehensive disease info in Hindi. Find detailed descriptions, effective treatments, reasons, symptoms, and practical household tips. Enhance your health knowledge and follow personalized treatment plans with ease.

Latest APP

-

- AI Anime Filter - Anime AI

- 4.4 Photography

- AI Anime Filter - Anime AI: Unleash Your Inner Anime Star! This cutting-edge mobile app uses artificial intelligence to transform your photos into stunning anime-style images. Explore a range of filters and customization options to create personalized anime avatars. Its intuitive interface and adv

-

- 1688 English

- 4 Photography

- 1688 English: Your Comprehensive English Learning App 1688 English is a robust language learning platform packed with resources and tools to help you master the English language. The app features interactive lessons, vocabulary builders, grammar guides, and speaking practice, designed to boost your

-

- Karaca: Ev, Yaşam ve Mutfak

- 4 Photography

- Enhance your home, kitchen, and dining experience with the Karaca: Ev, Yaşam ve Mutfak app! Explore over 1000 products using augmented reality, create personalized wish lists, and access exclusive online-only deals. Stay updated on the latest promotions and effortlessly track your orders. Advanced

-

- Nordstrom

- 4 Photography

- Unlock the ultimate Nordstrom shopping experience with the Nordstrom app! This app puts the best of Nordstrom at your fingertips, offering exclusive features designed for effortless shopping. Stay updated on your favorite items with alerts, discover personalized brand recommendations, and enjoy th

-

- Build.com - Home Improvement

- 4.5 Photography

- This all-in-one home improvement app simplifies your renovation journey. Build.com – Home Improvement App offers exclusive deals from top brands, making it your ultimate resource for any project, big or small. Need advice? Connect with LIVE Project Experts for free consultations. Track orders, re

-

- 3D Avatar Creator Myidol

- 4.4 Photography

- Myidol: Your Personalized 3D Avatar Awaits! Create stunning, customized 3D avatars with Myidol, a powerful yet user-friendly app. Enjoy extensive personalization options, from facial features and hairstyles to clothing and accessories, allowing you to craft an avatar that truly reflects your unique

-

- Castorama - Bricolage, jardin

- 4.2 Photography

- Calling all DIY fans! The Castorama - Bricolage, jardin app is your go-to resource for home improvement, decorating, and gardening. Its user-friendly design works seamlessly on phones and tablets, offering expert advice, exclusive perks, and convenient shopping features to guarantee successful pro

-

- Bass Pro Shops

- 4.1 Photography

- Experience the great outdoors with the Bass Pro Shops app! Effortlessly manage your Outdoor Rewards account anytime, anywhere. Your digital Outdoor Rewards card is always accessible, eliminating the need for a physical card. Plan your next adventure or shop for gear – this app enhances every aspe

-

- idealo: Price Comparison App

- 4.3 Photography

- Streamline your online shopping with idealo: Price Comparison App! This app simplifies finding the best deals, offering a comprehensive suite of features to enhance your shopping experience. From comparing prices and reviewing product details to setting price alerts, idealo empowers you to make inf

Breaking News

-

Emoak launches its latest casual puzzle game, now available on mobile platforms

-

No Snooze? You Lose! SF6 Tournament “Sleep Fighter” Requires You to Rest

-

Stumble Guys joins hands with My Hero Academia, heroic adventures are waiting for you!

-

-

Fortnite Re-Releases Paradigm Skin By Accident, Lets Players Keep It Anyways

-

Discover the Ten Dominating Cards in LUDUS: PvP Arena's Battle Royale